🇪🇺 Mistral AI's record funding, decline in VC activity and Italy's iGenius (next) unicorn

👋 Hello, I'm Davide and this is my weekly newsletter Seed Europe. Every Monday, I dive into what happened over the past week, highlighting key news, recent funding rounds, and newly announced venture capital funds.

🤑 Mistral AI raises €600 million in latest funding round

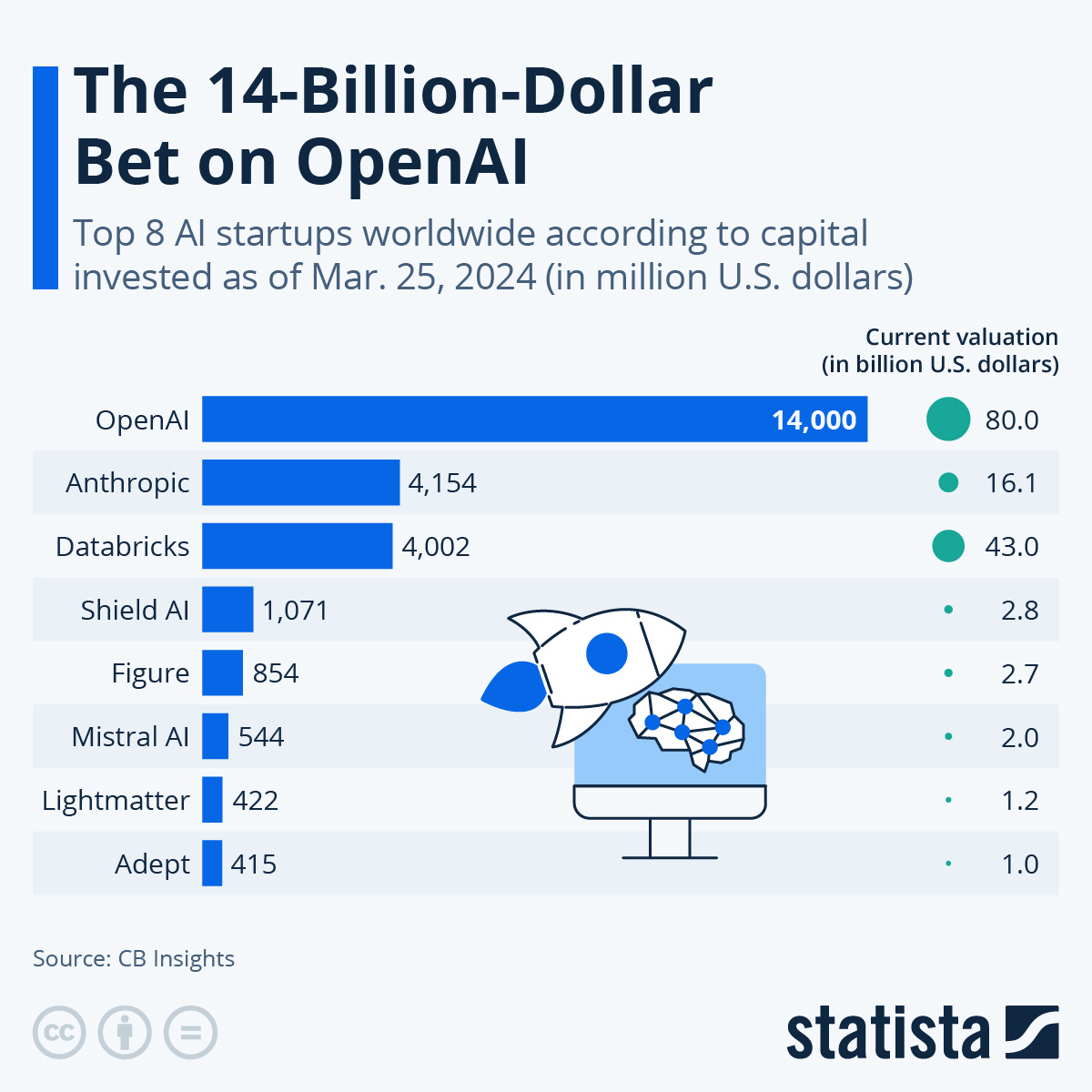

France's Mistral AI has secured €600 million in a Series B funding round led by General Catalyst, raising its valuation to €5.8 billion. This substantial increase from its previous €2 billion valuation reflects growing investor confidence in AI technology. Other key investors include Lightspeed, Andreessen Horowitz, Cisco Systems, and Nvidia. The funds will enhance Mistral's computing capacity, expand its workforce, and bolster its U.S. presence.

Co-founded by alumni from Meta and Google’s DeepMind, Mistral AI is developing foundational models aimed at rivalling today’s best-performing models, such as OpenAI’s GPT-4, Anthropic’s Claude 3, and Meta’s Llama 3. The company has released pre-trained and fine-tuned models under an open-source license with open weights. For instance, models like Mistral 7B, Mistral 8x7B, and Mistral 8x22B were released under the Apache 2.0 license, allowing unrestricted use and reproduction beyond attribution.

📉 European VC landscape faces sharp decline in active investors

The European venture capital landscape is experiencing a significant downturn, with the number of active VC investors falling by over 50% compared to last year. According to PitchBook, only 906 European VC investors made two or more deals globally in the past year, down from 1,955 in 2023. This decline is attributed to a sluggish fundraising environment and a shift in focus toward supporting existing portfolio companies rather than new investments.

The European VC fundraising total for 2023 saw a 50.7% drop in fund count and a 38% decrease in capital raised, with similar trends continuing into 2024. Some investors have even exited the market, and several firms have shut down or merged. Despite these challenges, a rebound in dealmaking activity is anticipated as the year progresses.

🦄 Italy aims to have its first Generative AI unicorn

iGenius, a deep-tech startup founded in 2016, is set to become Italy's first unicorn in the generative AI sector with its valuation soaring to €1.7 billion. The company, led by CEO Uljan Sharka, recently launched "Italia", an advanced large language model tailored for finance and public administration.

iGenius is raising €650 million in new funds, with early investments from Angel Capital Management and Eurizon Asset Management. The company's AI solutions aim to redefine data interpretation and management, offering scalable, reliable models for regulated industries. With offices in Milan and New York, iGenius is focused on expanding its AI capabilities and international presence. Their significant investment in AI technology has already attracted major clients like Fincantieri and Microsoft, and earned recognition from Gartner as a Cool Vendor in AI Core Technologies.

🚀 Last week's funding rounds

🇩🇪 Cardino secured €4M to accelerate EV secondary market from Point Nine , Rosberg Ventures, FJ Labs, and notable angel investors.

🇸🇮 SaleSqueze secured $1.5M to enhance its automated sales platform from Underline Ventures, Robin Capital, Fortech Investments, and several angel investors.

🇫🇷 ZELIQ secured $10M to boost sales with AI-powered data and outreach automation from Exor Ventures and Resonance VC.

🇩🇰 Light secured €12.1M to scale general ledgers for global company finances from Atomico, Entrée Capital, Cherry Ventures, Seedcamp, and angel investors.

You can find all the rounds announced here.

💰 New funds announced

Italian Founders Fund has closed its inaugural fund at €50 million, targeting seed and pre-seed startups led by Italian founders.

Vsquared Ventures has closed its latest fund at €214 million, targeting investments in European deeptech startups.

Invest-NL and the European Investment Fund (EIF) have announced a €35.7 million fund to support sustainability projects by Dutch SMEs.

Equilibrium Ventures (EQV) has reached the first close of its €30 million fund, aiming to invest in seed-stage crypto startups across Europe.

🎟️ Startup events around Europe

The Next Web Conference | 🇳🇱 Amsterdam | 📅 20-21 June

TechBBQ | 🇩🇰 Copenaghen | 📅 11-12 September

Italian Tech Week | 🇮🇹 Turin | 📅 25-27 September

💼 Looking for a job?

Here some interesting open positions:

Cusp Capital | Visiting Analyst | 🇩🇪 Essen

Ona Capital Privat SCR | Analista Venture Capital | 🇪🇸 Manlleu

Speedinvest | VC Associate | 🇬🇧 London

Asset Partners | Investment Associate / Investment Manager | 🇦🇹 Vienna