European Startup funding surges in Q2 2024

What happened in the European startup and VC ecosystem over the past week

👋 Hello, I'm Davide and this is my weekly newsletter Seed Europe. Every Monday, I dive into what happened over the past week, highlighting key news, recent funding rounds, and newly announced venture capital funds.

🇪🇺 European Startup funding surges in Q2 2024

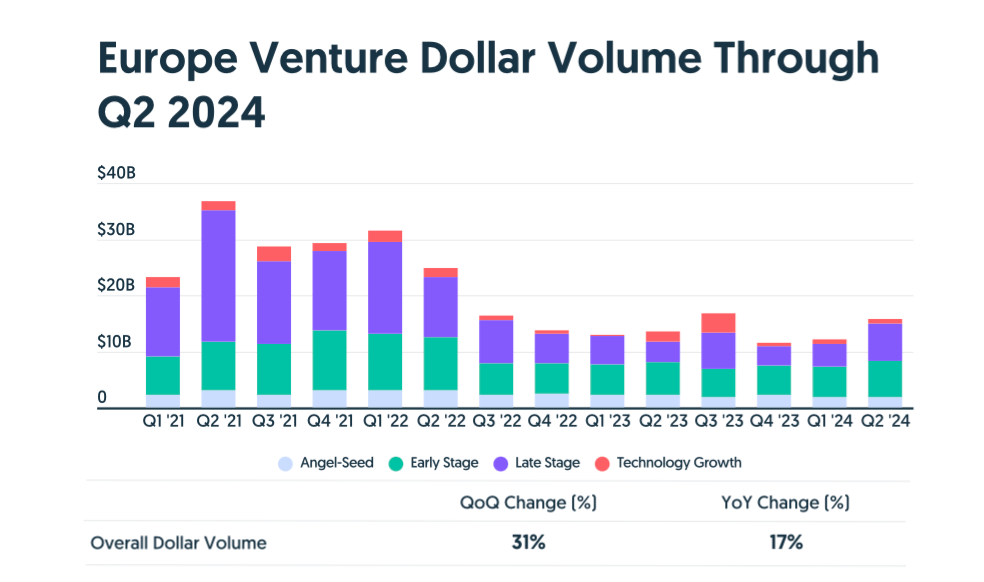

European startups saw funding surge to nearly $16 billion in Q2 2024, marking a 31% increase from the previous quarter and a 17% rise year-over-year, according to Crunchbase. For the first time in a decade, Europe surpassed Asia in quarterly startup funding. The UK led with $6.7 billion, followed by France with $2.9 billion, while Germany saw a decline to $1.8 billion.

AI was the top-funded industry with $3.3 billion, driven by investments in Wayve, Mistral AI, and DeepL. Financial services followed with $3 billion, including major rounds for Abound, GB Bank, and Monzo. Sustainability also saw significant investments, totaling $2.5 billion.

Late-stage funding grew to $7.5 billion across over 100 rounds, while early-stage funding reached $6.5 billion across 300 rounds. Seed-stage funding declined to $1.8 billion from $2.3 billion in Q2 2023.

Notable acquisitions included Bridgepoint’s $650 million stake in LumApps, Voodoo’s $500 million acquisition of BeReal, and LexisNexis’s $160 million purchase of Henchman.

Three new unicorns emerged, bringing the total to 208. Overall, European startups had a strong quarter, with significant growth in AI funding and positive revenue reports from major companies.

🗞️ Other news

Semrush has acquired Munich-based Ryte to enhance their combined website optimization and online visibility solutions. LINK

Amsterdam-based VanMoof launched a global initiative to help customers who ordered bikes before the company's bankruptcy by offering discount codes and enhancing support services. LINK

Enerpoly acquired Nilar's production line and dry electrode technology to boost zinc-ion battery manufacturing, enhancing their industrial capabilities and promoting European innovation. LINK

Meridien Holdings has acquired a 27% stake in London-based fintech DKK Partners to support its global expansion and enhance its financial services capabilities. LINK

Cash App is exiting the UK market on September 15th to prioritize its focus on the US, stating that global expansion is no longer a priority. LINK

🚀 Last week's funding rounds

🇩🇰 Landfolk raised €10.3M to expand its vacation rental platform across Europe.

Investors: Export and Investment Fund of Denmark, Seed Capital Denmark, HEARTLAND

🇩🇪 WorkerHero raised €4M in Series A to enhance its AI-driven recruitment platform for blue- and grey-collar workers in Germany, Austria, and Switzerland.

Investors: Mediahuis Ventures, 10x Founders, Bonsai Partners

🇮🇹 Cubbit raised $12.5M to enhance its geo-distributed cloud storage solution.

Investors: LocalGlobe, ETF Partners, Verve Ventures, 2100 Ventures, Hydra, Growth Engine, Eurenergia, Moonstone Venture Capital, Azimut Libera Impresa SGR, CDP Venture Capital SGR, Primo Ventures, Fabio Fregi, Joe Zadeh

🇵🇹 Indie Campers raised €35M to enhance its RV rental experience worldwide.

Investors: Indico Capital Partners, Cedrus, GED Ventures Portugal

You can find all the rounds announced here.

💰 New funds announced

Marktlink Capital has launched its second venture capital fund-of-funds, securing €80 million from approximately 150 private investors to invest in top venture capital funds across Europe and North America, focusing on technological trends such as AI.

Mundi Ventures has launched the €25 million LATAM-focused Insurtech Fund to invest in insurtech startups across Latin America, aiming to improve and digitalize the insurance sector and promote inclusion and protection for underserved populations.

British Business Investments has partnered with Claret Capital Partners to launch a new co-investment fund aimed at high-growth technology-enabled smaller businesses across the UK, further supporting innovation and growth in the technology sector.

ZAKA has launched a €15 million Fund I to invest in early-stage startups in Central Europe, the Baltics, the UK, DACH, and the US, focusing on B2B software, AI applications in B2B, biotech and health tech, aiming to bridge the gap between the US and EU markets.

13books Capital has launched the €144 million 13books Fintech Fund to invest in 20-25 fintech startups across Europe, focusing on late Seed and Series A stages, with the aim of supporting next-generation financial technology disruptors.

NewPort Capital has launched the €300 million NewPort Buyout Fund III to invest in Dutch mid-market companies, focusing on sectors like manufacturing, business services, financial services, and food packaging.

🎟️ Startup events around Europe

SHIFT | 🇫🇮 Turku | 📅 22-23 August

TechBBQ | 🇩🇰 Copenaghen | 📅 11-12 September

Infobip Shift | 🇭🇷 Zadar | 📅 16-17 September

Italian Tech Week | 🇮🇹 Turin | 📅 25-27 September